≠Mortgage Insurance may be required for loans that have a less than 20% down payment which will increase the APR and result in a higher loan payment. Interest rates and fees are subject to change without notice. Huntington's mortgage division offers many different mortgage products; your APR may vary depending on the product for which you apply. All loans are subject to loan application and credit approval and receipt of a property appraisal demonstrating sufficient value.

Investment, trust and annuity account balances will be assessed based on the account balances that are periodically reported to Huntington systems by a variety of third party sources. Huntington's Mortgage Relationship Discounts are subject to change without notice. Program eligibility is subject to account and balance validation. With Well Fargo's most basic business bank account, you can make up to 50 transactions per month at no charge and deposit up to $3,000 in cash each month. (Deposits above $3,000 will incur a 30-cent fee per $100.) Although this account has a $10 monthly service fee, you can avoid the cost by maintaining a $500 average balance.

With a minimum opening deposit of just $25, this simple business banking solution is excellent for the small business with limited cash-flow activity. With all Wells Fargo business checking accounts, you can apply in person or online, and send your deposit and required documents later. This straightforward business checking account offers 100 transactions per month at no charge, plus unlimited electronic deposits and up to $5,000 in cash deposits per statement cycle. The $15/month fee drops to $12 when you opt for paperless statements and to $0 when you maintain a $1,500 minimum daily balance or link a Chase private checking account. An account requires a $25 minimum deposit to open, and includes multiple debit cards for employees. You'll have to apply in person for an account, and while Chase has 5,100 branches across 31 states, most are found only in major markets.

1 Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Spending Account each month. Your limit will be displayed to you within the Chime mobile app. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Friends transfers, or Chime Checkbook transactions. It offers three kinds of zero balance savings account, which are a basic savings bank deposit account, a regular savings account, and a digital savings account.

These accounts do not have a minimum balance requirement that customers have to maintain. A basic savings bank deposit account allows limited cash withdrawals on a monthly basis, which is four in this case. Some of the facilities it offers are free quarterly statement, zero balance account opening, linkage to Post Office savings account, IMPS facility, etc. A regular savings account can be opened with a zero balance by visiting the bank's access point or even by requesting the doorstep service.

Some of the facilities offered are IMPS service, free quarterly account statement, etc. The digital savings account can be opened on the bank's mobile app which is available on Google Android. There is no need for a monthly average balance and can be opened with zero balance. Other facilities offered are IMPS and free quarterly account statement. The good news is that you can still open a free online bank account with no credit check, no monthly fees, or minimum balance requirements. CheckingExpert has helped thousands of people just like you open online bank accounts.

No credit check bank accounts that give you all the checking account features you need and deserve without the exorbitant fees many banks impose. †Subject to terms and conditions and other account agreements. Available through online banking or the Huntington Mobile app to individuals with an active consumer checking account open at least three months with consistent monthly deposit activity of $750 or more. Amount available through Standby Cash is subject to change based on changes to customer eligibility, including checking and deposit activity, overdrafts, and daily balances. A 1% monthly interest charge (12% Annual Percentage Rate) will be added to outstanding balances if automatic payments are not scheduled.

If 100% of the approved credit line is drawn three months in a row, Standby Cash will be suspended until it's paid to a zero balance. When any of your Huntington deposit accounts are in an overdraft status for more than one day, your Standby Cash line will be suspended until they are no longer negative. Business checking accounts are not eligible for Standby Cash. † Subject to terms and conditions and other account agreements. TD Bank offers two different bonuses for new checking account customers.

The first is a $300 bonus for a brand new TD Beyond Checking account. New clients qualify for the bonus after making $2,500 in direct deposits within the first 60 days of opening the account. There is no minimum deposit to open the account, but it comes with a hefty $25 monthly fee. This fee is waived if the customer maintains a $2,500 minimum daily balance. The account pays interest, and there are no charges for non-TD automated teller machine transactions.

It's becoming increasingly difficult to find truly free checking accounts. At many banks, you're now required to pay a monthly maintenance fee for the privilege of keeping your checking account open. Such fees can range from a few dollars to $20 or more, depending on the bank and other associated perks. To avoid these fees, you may need to maintain a high minimum daily balance, make regular deposits of a certain size or frequency, or execute a minimum number of transactions in a statement period. Wells Fargo Clear Access Checking.The Wells Fargo Clear Access Checking Account is only offered if you are unable to open one of their regular checking accounts.

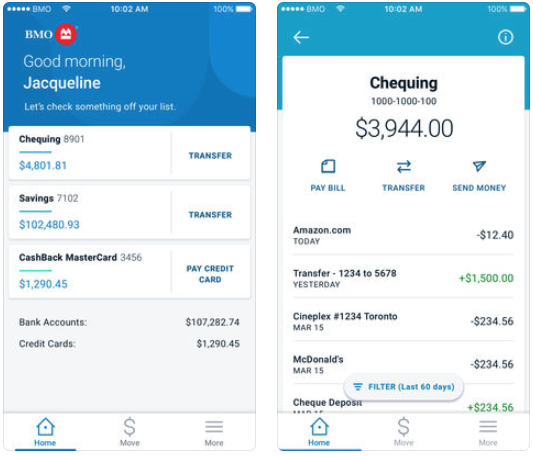

The $10 monthly fee can be avoided by maintaining a $1,500 minimum daily balance, setting up direct deposits totaling at least $500, or posting 10 or more debit card transactions each cycle. Once you have a checking account, you can pay bills, transfer money, use an ATM and make purchases with a debit card. We offer a variety of checking accounts with options such as online and mobile banking to make it easy to bank when and where you want. The bank's checking account earns 1% cash back on up to $3,000 of qualifying debit card purchases each month. The savings account pays a competitive rate and Discover offers a suite of other products and services.

BlueVine Business Checking has no monthly fees, no minimum opening deposit and no minimum balance requirements. This free online business checking account includes unlimited transactions, plus it allows you to earn 1% interest on your account balance up to $100,000. Chime makes it easy to deposit and transfer your money with its free mobile app. You'll get access to automatic deposits, online transfers, mobile banking, and ATM withdrawals.

This free checking account also comes with online bill pay, direct deposit, and a Visa debit card. The Basic Savings Bank Deposit account of the State Bank of India does not have a mandatory minimum average balance. This is to encourage the economically disadvantaged sections of society to start banking with savings accounts without worrying about penalties for not maintaining the minimum balance. There are other facilities offered along with these accounts, such as ATM cards, debit cards, and internet banking. The account is open to all irrespective of economic background. It can be opened with anyone or survivor, former or survivor, and either or survivor.

A debit-cum-ATM card that is RuPay is offered without any annual maintenance charges and totally free of cost. The receipt or credit of money through NEFT or RTGS is free of charge. The collection or deposit of cheques that are drawn by state and central governments is also free. For closure of accounts or inoperative accounts, there is no charge on activation. This account offers interest rates that are similar to regular savings accounts. For balance in the savings account that is up to Rs.1 crore, the interest rate is 3.5% p.a.

For balance that is above Rs.1 crore, the interest is 4% p.a. Drawbacks include high fees for replacement debit cards, high minimum balance requirements for the best annual yields, and no out-of-network ATM fee reimbursements. If your business bank account needs are fairly simple and you require few monthly transactions, this SunTrust account could be a good option.

The $5 monthly maintenance fee is waived for the first year, after which you can avoid it when you make at least five debit or credit transactions per month or link a SunTrust personal checking account. The account includes 50 transactions and $2,000 in cash processing per month. SunTrust clearly outlines all stipulations and rules on its site, allows you to apply online, and has some great small-business resources online.

For most small businesses, a business checking account is essential. Opening one will allow you to pay invoices, bills, and employees from your business account; receive payments ; withdraw cash; and more. Since you'll want to start with opening a business checking account first, the information below is focused on helping you find the best checking account for your small business. But if you have even a small cash reserve, there's value in opening a savings account, too.

A savings account can boost your business credit, earn interest, and help you maintain minimum balance requirements. This prepaid debit card account is good for people that have bad credit and are in ChexSystems because they don't use any type of checking account reporting company. Earn up to 1.00% cash back on signature-based transaction purchases. Earn up to $2,000.00 per month in cash back on your signature-based transactions. Maintain a $1,500.00 average daily collected balance to earn 1.00% cash back on signature-based transaction purchases. If your average daily collected balance falls below $1,500 you will earn .50% in cash back for the month.

Cash back will be calculated and paid on your monthly statement cycle date. Cash back is paid in the form of a deposit to your Axos Bank CashBack Checking account. Your total cash back earnings may be reported as miscellaneous income to the IRS on a 1099-MISC form.

Axos Bank cannot control how merchants choose to classify a transaction; Axos Bank cannot guarantee a transaction will qualify. Purchases made at Super Markets, Super Stores, Grocery Stores, Wholesale Stores, Discount Stores, USPS, and financial or money transfer institutions are not eligible. Purchases made using virtual wallets, funds transfer services, or other similar technology are not eligible. The Bank has the right to change or cancel this program at any time. If you're running a small business that's quickly expanding, an upgrade to this Citizen's account may give you a nice boost.

Perks include 500 free check transactions per statement period, $100 off your first order of checks, a 10 percent discount on payroll services, and a business credit card with no annual fee. Combine the balances of your business loans, savings, and money market accounts to help waive monthly maintenance fees. This bank has no monthly fees or minimum balance requirements for its checking or savings products. Customers have access to an extensive ATM network and automatic savings tools. You may even receive your paycheck up to two days early with direct deposit. Look for business checking accounts that have no monthly service fees and no minimum balance requirements.

And pay close attention to the fine print — some accounts are free only if you maintain a daily or monthly minimum balance or can meet another qualification to waive the service fee. The Lili Account is a free checking account designed for freelancers, side hustlers, and solo professionals. That's a rare find in a banking industry rife with mediocrity.

Quontic Bank offers a cash rewards checking account that pays up to 1.50% cash back on qualifying debit card transactions each statement cycle. The bank also offers a separate high interest checking account that pays up to 1.01% APY so long as certain monthly requirements are met. The Axos Basic Business Checking account has no monthly maintenance fees but requires a minimum deposit of $1,000 to open the account. This online business checking account includes 200 fee-free transactions per month, 30 cents per transaction after that.

You can earn up to 1% cash back on up to $3,000 worth of qualifying debit card purchases per month. The checking account doesn't come with a monthly fee, and you can pair it with a high-interest savings account. Unfortunately, discover only has one brick-and-mortar location, but they do have an extensive ATM network. Investment, trust and annuity account balances will be assessed based on their respective balances that are periodically reported to Huntington systems by a variety of third-party sources. Your specific Rate Discount will depend on the total amount of qualifying balances that correspond to our balance requirement discount rate tier grid. We will continue to waive your Annual Fee as long as you continue to maintain your qualifying checking account in good standing with us.

Rate Discount eligibility is subject to account and balance validation when Huntington prepares your PCL agreement for your signature. Banks and other financial institutions earn money from many sources. One such source is the revenue they receive from—on-average—over 30 potential fees on checking accounts, according to The Wall Street Journal.

These fees include monthly maintenance, non-sufficient funds charges, overdraft fees, paper statement charges, and dormant account fees among others. However, a cash back promotion can be a win-win for banks and consumers alike, as long as the latter remain aware of the pitfalls that could threaten their deposits. Our checking accounts have all the convenience your lifestyle demands.

Several bank accounts have no minimums to open and no balance requirements. We make every day checking easy with the best online and mobile options so you can pay your bills and loans online, anywhere, anytime. Chime is a mobile-first banking app that merges the low cost of online checking and savings accounts with the convenience of truly on-the-go banking. The headline here is Chime's promise – subject to the policies of payers and their banks – that its Deposit Account customers get paid two days faster with direct deposit.

If you're accustomed to Friday paydays but could really use the money on Wednesday, the Chime Deposit Account may be the free checking account you've been waiting for. You'll also get a free detailed analysis of your account activity. Visit a branch, call, or mail in your completed application to open an account, with just $50 as an opening deposit.

Though there are only three American First branches—all located in California—you can conduct routine transactions at any of 5,000 cooperative credit unions across the nation and have access to 30,000 free ATMs. With just $100 required to open an account, you'll also get free online bill pay for up to 15 payments per month. With this PNC business bank account, there's no charge for up to 500 combined transactions per month.

With more opportunities to offset monthly account maintenance fee than the company's Business Checking account, Business Checking Plus also offers cash-flow insight and analysis at no charge. You can also earn cash back with PNC's rewards program, and the bank's Quick Switch Kit makes it easy to switch banks. Applying online or in person with a minimum opening deposit is just $25 for this account—that's a terrific value with great flexibility for growing businesses. The Depositor agrees that the Depositor's account/s, whether active or dormant, shall be subject to such service charges imposed by the BANK.